In today’s globalized world, characterized by ever-evolving technologies, fast-changing regulations, and the increased knowledge and expectations of people, it is crucial for business leaders to recognize that a lack of ethics can lead to fatal and irreversible consequences. Such consequences not only impact the organization itself but also affect customers and society at large (Boyles, 2023). Ethical corporate governance is essential in today’s context, as it can prevent systemic risks within institutions (Schwarcz, 2017) and safeguard global financial stability (Forum, 2023).

Ethical Leadership Deontological vs Teleological?

The type of ethical leadership varies among different financial institutions, yet they are all mandated to adhere to principles established by regulators. These principles are designed to yield positive and desirable outcomes that benefit the entire economy. Ethical leaders in these institutions are expected to shape the company’s strategy and objectives, hire suitable individuals to manage daily operations, safeguard the interests of customers, shareholders, and other stakeholders, promote a positive corporate culture, and ensure compliance with relevant laws and regulations. Additionally, they must implement a robust control environment to meet financial, operational, regulatory, and legal requirements (Basel Committee on Banking Supervision, 2015).

Deontological Principles

In large financial institutions with utilitarian cultures, top management leaders, including the board of directors and senior management, primarily focus on business goals and performance evaluations of the staff. Consequently, the management’s emphasis on these aspects can overshadow the ethical culture of the company and influence the moral behavior of the staff (van Staveren, 2020).

Despite compliance with applicable regulations and deontology, involving the implementation of strict policies, processes, and procedures for all staff to meet regulatory obligations, these measures have not always prevented crises or breaches in the financial sector. Many of these incidents occurred due to weak corporate governance stemming from poor ethics (Santa Clara University Leavey School of Business, 2023). This issue is exemplified in the recent collapses of multinational banks such as Credit Suisse (Englundh, 2023) and BSI Bank (Monetary Authority of Singapore, 2016).

Teleological Principles

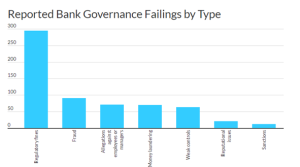

Despite the profit-ethics conflict, regulators focus on financial sectors’ risk culture, ethics, and conduct, forming the basis of public trust (European Central Bank, 2022). Staff and senior management must prioritize ethical decisions, fostering a strong organizational culture with ‘hardware’ (policies) and ‘software’ (values) (Monetary Authority of Singapore, Sep 2020). Upholding ethical standards is vital; non-compliance leads to costly reputation damage (Auburn University). Leaders must weigh consequences, emphasizing good corporate governance (Fitch Ratings, 2022).

Figure 1- Reported Bank Governance Failings by Type

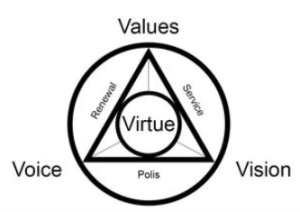

4V Model of Leadership

Setting a good ethical and compliance culture

Values and Virtues

The board and senior management of financial institutions play a pivotal role in defining ethical and conduct standards. They must set the right tone from the top to ensure that desirable ethical standards are cascaded down and embedded within the financial institutions. This should be reinforced by internal policies and procedures. It is their responsibility to promote integrity, honesty, and fairness among all staff. Moreover, the board and senior management should be accountable for the ethical conduct of the financial institutions(Carse, 1999).

Vision

Financial institutions should work towards a long-term vision and goals that involve providing a cost-efficient, dynamic, and customer-conducive banking platform, ensuring the highest level of customer experience. Additionally, conducting business in ethical ways and implementing effective risk management are paramount. This includes managing systemic risks and preventing regulatory financial penalties. These responsibilities ultimately lie with the board and senior management of the institutions (OECD, 2009).

Voices

Financial institutions should implement an independent and effective whistle-blowing programme for staff to report wrongdoings to reduce misconduct, and create a safe environment for whistle-blowers to protect them against reprisals (Transparency.org, n.d.).

Conclusion

It is widely acknowledged that businesses with little or no ethics may achieve short-term goals, but this approach inevitably jeopardizes the long-term sustainability of the business. This idea is encapsulated in the famous quote by former SEC Chairman John Shad, ‘Ethics pays’ (Lawson, 1988). In conclusion, effective and ethical leadership should strike a balance between deontological and teleological approaches. This involves assessing risks, understanding the consequences of actions, and continually enhancing internal policies and procedures to ensure positive outcomes for institutions. Such an approach represents a better choice for sustainable and ethical business practices.

References

Auburn University. (n.d.). Wells Fargo Banks on Recovery. Center for Ethical Organizational Cultures, 13.

Basel Committee on Banking Supervision. (07, 2015). Corporate Governance principles for banks. Retrieved from Bank for International Settlements:

Boyles, M. (27 07, 2023). What Are Business Ethics & Why Are They Important?: HBS Online. Retrieved from Business Insights Blog: https://online.hbs.edu/blog/post/business-ethics

Carse, D. (14 09, 1999). The Importance of Ethics in Banking. Retrieved from Hong Kong Monetary Authority: https://www.hkma.gov.hk/eng/news-and-media/speeches/1999/09/speech_150999b/

Englundh, J. (21 03, 2023). Credit Suisse’s Demise: A Timeline of Scandal and Failures. Retrieved from Morningstar HK: https://www.morningstar.hk/hk/news/233221/credit-suisses-demise-a-timeline-of-scandal-and-failures.aspx

European Central Bank. (25 01, 2022). Ethics – working with integrity. Retrieved from European Central Bank: https://www.ecb.europa.eu/ecb/orga/ethics/html/index.en.html

Fitch Ratings. (11 08, 2022). Regulatory Fines Dominate Reports of Bank Governance Failings. Retrieved from Fitch Ratings: Credit Ratings & Analysis For Financial Markets: https://www.fitchratings.com/research/banks/regulatory-fines-dominate-reports-of-bank-governance-failings-11-08-2022

Forum, W. E. (28 03, 2023). What is systemic risk and how does it lead to a banking crisis? Retrieved from World Economic Forum: https://www.weforum.org/agenda/2023/03/what-is-systemic-risk-and-how-does-it-lead-to-a-banking-crisis/

Lawson, G. (1988). The Ethics of Insider Trading. Boston University School of Law .

Monetary Authority of Singapore. (24 May, 2016). MAS directs BSI Bank to shut down in Singapore. Retrieved from Monetary Authority of Singapore: https://www.mas.gov.sg/news/media-releases/2016/mas-directs-bsi-bank-to-shut-down-in-singapore

Monetary Authority of Singapore. (Sep 2020). Information Paper: Culture and Conduct Practices of Financial Institutions (FIs). Monetary Authority of Singapore, 17.

OECD. (2009). Corporate Governance and the Financial Crisis . OECD, 60.

Santa Clara University Leavey School of Business. (29 03, 2023). Ethics in Corporate Governance. Retrieved from Santa Clara University: https://onlinedegrees.scu.edu/media/blog/ethics-in-corporate-governance#:~:text=Done%20well%2C%20%E2%80%9Ccorporate%20governance%20leads,which%20leads%20to%20financial%20viability.%E2%80%9D&text=Read%20on%20to%20learn%20about,today’s%20most%20successful%2

Schwarcz, S. L. (2017). Controlling Systemic Risk through Corporate Governance. Centre for International Governance Innovation, 12.

Transparency.org. (n.d.). Whistleblowing – Our priorities. Retrieved from Transparency.org: https://www.transparency.org/en/our-priorities/whistleblowing

van Staveren, I. (2020). The misdirection of bankers’ moral compass in the organizational field of banking. Cambridge Journal of Economics, 20.

Good read. The author brought certain insights of the glamour of the financial industry. The age of “too big to fail” had vanished and if financial institutes refused to self regulate based on ethics, sooner or later ethics will be an afterthought.

Thank you Gabriel. No institution is too big to fail and CSR and ethics are important.

Great Article, Very informative with Deontological and Teleological.

Thank you Esther.

“Your blog on ethical leadership in modern finance is a timely and insightful exploration of a topic that is becoming increasingly important in today’s financial landscape. The convergence of finance and ethics is crucial in an era where trust and responsibility are paramount.

Thank you David.

Great article on the deontological and teleological principles in large financial institutions. Insightful read about the importance of ethics and values in the financial sector.

Thank you Cindy. Yes though most of them has policy but effective implementation of it is the hardest part.

Nice article, summarised with good recommendation. Agree with the statement of “It is widely acknowledged that businesses with little or no ethics may achieve short-term goals, but this approach inevitably jeopardizes the long-term sustainability of the business”

Thank you Delwar.

Nice blog, independent and effective whistle-blowing programme for staff is usually taken in wrong sense many a time, but its the right doing.

Thank you for ur comment. Yes you’re right, companies and top leaders should take whistleblowing positively and often whistleblowers are not legally protected, that makes it hard to implement effectively.